内容来源:MARS,一点编辑于 2020-04-13 提示:新闻观点不代表本网立场

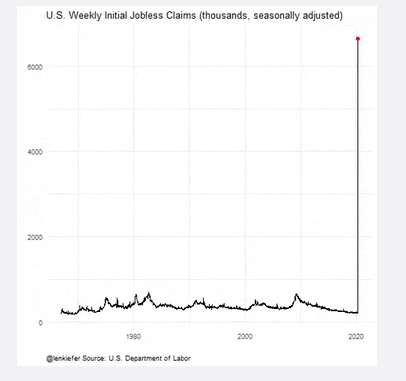

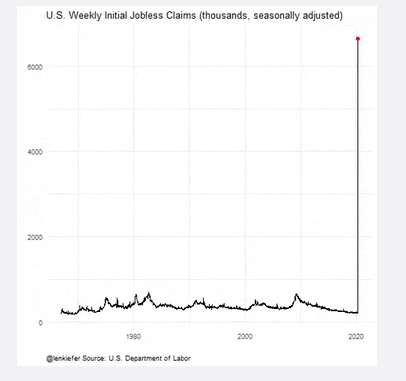

随着新冠肺炎的全球爆发,美国劳工部公布了失业情况,严重程度超过911和历次金融危机。

4月9日美国有660万人申请救济金,一些经济学家表示,疫情可能使失业率达到14%,高于上一次金融危机的峰值。

美国各州中,加州报告的失业救济申请数量最高,为925,450例,乔治亚州报告为388,175。密歇根州记录了384,844例,而纽约州报告了345,246例。 各州报告指出,影响服务业受疫情影响最重,包括食品服务和零售。医疗保健,社会救助,艺术和娱乐,建筑和制造业也受到了很大影响。

美国总统特朗普签署了2万亿美元的经济刺激方案,意在帮助美国经济渡过难关,覆盖范围空前,包括自雇人员和兼职人员。这能帮助更多的美国人申请救济金。

受此2万亿经济刺激方案影响,美国10年期国债收益率上升0.02%,至0.74%,股市开盘上涨约1%。非农就业报告显示,3月份美国裁员70.1万人,失业率达到4.4%,为近2年多来最高。

截止4月11日,美国已有约43.5万确诊病人,死亡人数约1.47万,而世界范围已有150万确诊病人,死亡人数超过8.8万。

预期美国今年前两季度GDP将大幅下降,而新西兰经济形势也不容乐观,为期4周的封锁已经造成国家经济濒于瘫痪,很多中小企业都很难继续支撑超过1个月。

新西兰餐饮协会CEO Marisa Bidois称,受疫情影响,该行业已削减数百个工作岗位,未来还将有数千人失业。此外新西兰餐饮行业每周亏损月600万新西兰元,而总损失将超过10亿新西兰元。

在未来6个月,新西兰旅游行业将损失121亿新西兰元,并将削减10万个工作岗位。Flight Centre已关闭全国58家门店,裁员300名员工。新西兰航空也在疫情中苦苦挣扎,预计将裁员1500人。Bauer Media集团受疫情影响,裁员300名员工。

财政部预估失业率将增加5%,甚至更高。而当前的失业率为4.3%,这意味着为期4周的封锁期结束后,失业率将达到10%,或者更糟。

以下是英文原文:

Department of Labor of United States had published a graphic demonstration of the growth of weekly jobless claims after the outbreak of the epidemic of Covid-19 that stroked the country began a monthly ago. The graph has indeed shocked everyone. The impact is not comparable to any other recession in the history. It has surpassed the financial crisis, 911, and even the worst of all, the Great Depression.

The invisible tiny virus hits the US labour market and brought the worst outcome in the human history. US weekly jobless claims hit 6.6 million on 9th of April.

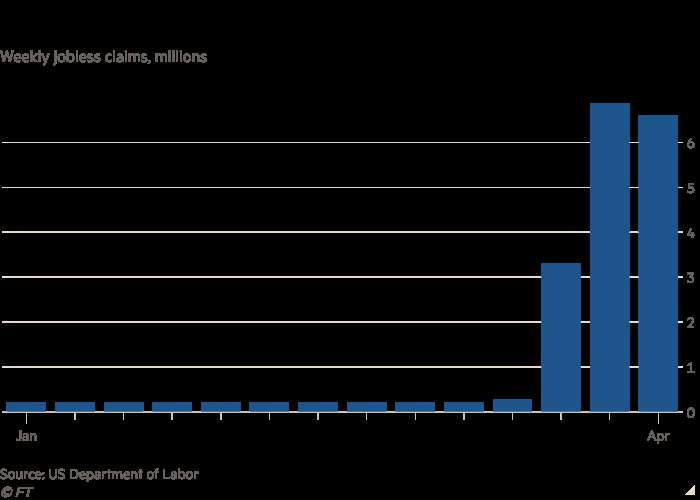

As per Financial Times, this result happened for the third consecutive week after the coronavirus pandemic forced the closure of non-essential businesses and sent shockwaves through the US labour market.

Initial jobless claims remained elevated in the week ended April 4 but were lower than the 6.87m recorded the previous week, the labour department said on Thursday. However, they eclipsed economists’ expectations for 5.5m.

The latest figures take the cumulative total since the March lockdowns began to almost 17m — a number of economists said could put the unemployment rate at 14 per cent, above the peak in the last financial crisis.

According to advance state-level estimates that have not been seasonally adjusted, California reported the highest number of jobless benefits filed at 925,450, while Georgia reported 388,175. Michigan recorded 384,844, while New York, which has been the US epicentre for Covid-19, reported 345,246 claims.

States reported that shutdowns continued to primarily affect the services sector, including food services and retail. However, healthcare, social assistance, arts and entertainment, construction and manufacturing also experienced pain.

Despite the modest dip this week economists have cautioned that the number of claims could still reach new records in coming weeks as the $2tn stimulus package signed into law by US president Donald Trump has expanded eligibility to include people that are self-employed or part of the gig economy and extended the number of weeks Americans can file for claims. States also face a massive backlog in unemployment insurance claims as their websites and phone lines are overwhelmed.

Treasuries sold off slightly following the release of the figures, but it was more related to news of the US central bank’s move to offer an extra $2.3tn in credit and support the market for high-yield corporate debt. The yield on the 10-year Treasury note gained roughly 0.02 percentage points to rise to 0.74 per cent. The more policy-sensitive two-year note steadied at 0.24 per cent. US stocks climbed 1 per cent at the open.

The jobless claims figures have gained more prominence because they provide a more up-to-date snapshot of the American job market than the non-farm payroll report, which showed the US economy shed 701,000 jobs in March and the unemployment rate jumped to a 2.5 year high of 4.4 per cent.

The number of coronavirus cases in the US has surpassed 435,000, while the death toll has climbed to more than 14,700, though hopes are rising that the outbreak could be nearing its peak domestically. Globally, confirmed cases have exceeded 1.5m and while the death toll has topped 88,000.

The outbreak has ripped through the global economy, with the US expected to post sharp GDP declines in the first and second quarters. On the other end of the world, New Zealand couldn’t survive on its own. The 4 weeks national lockdown also paralyzed almost all economic activities in the country, despite some of the essential sectors, including emergency service, medical and pharmacy, primary sector and food industry, but the majority of the economic development sectors, were all forced to shut during a month period.

Not only the parties in the Opposition is arguing, but representatives of several big business associations had popped out to media, claiming that their fellow business members, especially the small to medium sized ones, are dying. Marisa Bidois, CEO of Restaurant Association of New Zealand, assumed of the post pandemic picture of the hospitality and restaurant industry of New Zealand. Currently speaking, hundreds of jobs had vaporised, and this number will grow up to thousands. The industry has making a loss of 6 million dollars weekly. Total loss from the impact will be about 1 billion dollars.

This was only a proportion if you compare the data of the Tourism Industry as a whole. In the following six months, the industry would lose 12.1 billion dollars and about 100,000 jobs would be eliminated. In February, 9000 tourist groups had been cancelled with 90% of them from China.

Flight Centre, one of the most familiar brands from the industry in the country, has permanently shut 58 stores nationwide, 300 staff had been sacked.

Air New Zealand is struggling for survival, an estimation of 1500 staff to be sacked had shocked the market.

Not to mention the sorrowful departure of Bauer Media Group, the beloved media giant with several its famous magazine brands became the first victim at the early stage of the lockdown. The permanent closure resulted with 300 staff to be sacked, thousands of freelancers will be affected.

Ministry of Finance had estimated that the unemployment rate will increase by 5%, or even a double-digit figure. Current unemployment rate is 4.3%, that means after the lockdown, the number will be around 10%, which is the most optimised result, but it could be whole a lot worse.