内容来源:MARS Realty,一点编辑于 2020-09-25 提示:新闻观点不代表本网立场

上周,住房贷款利率又创新低,这对购房贷款者是个好消息!

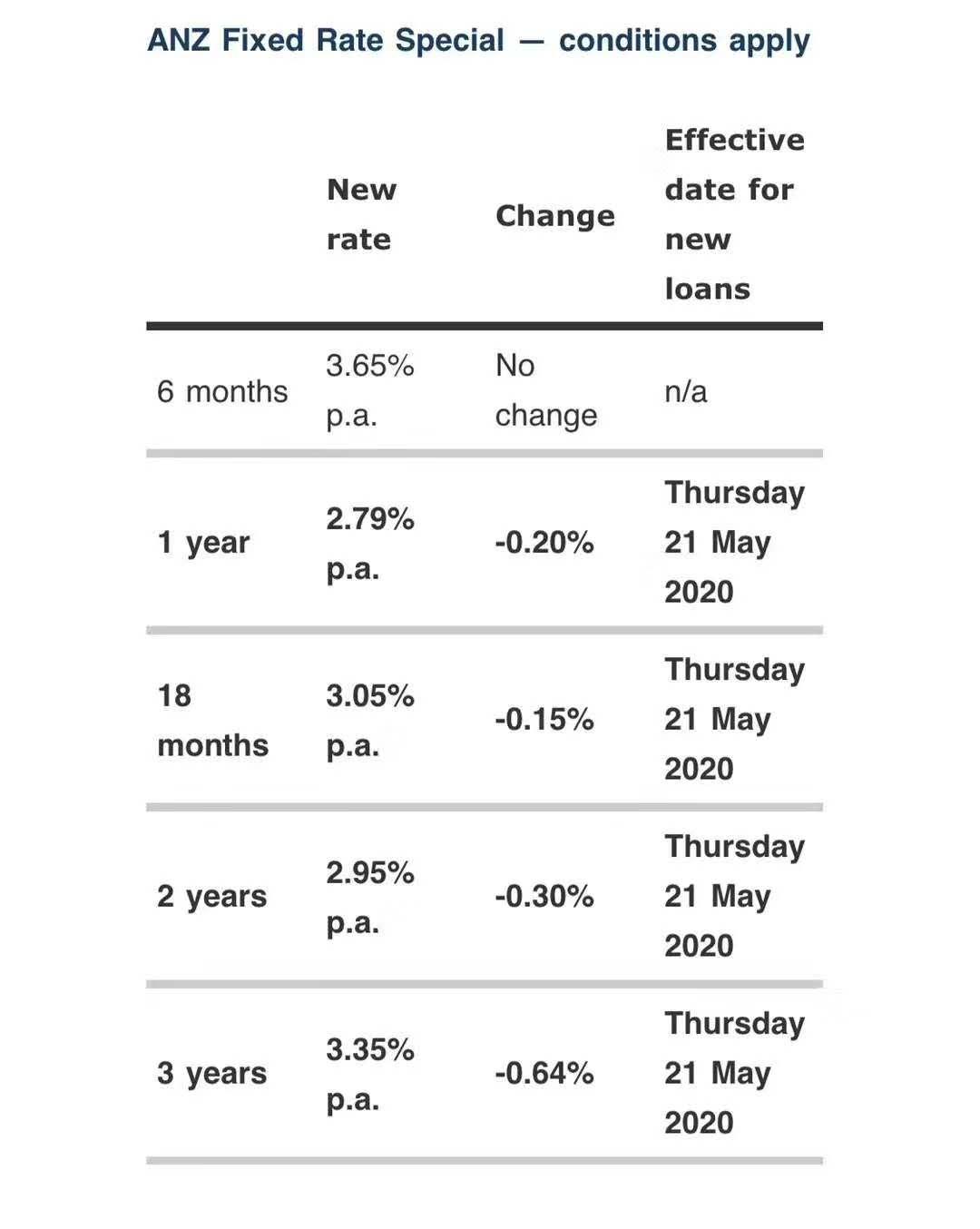

仅仅在一周以前,ANZ银行一年期贷款利率下调至2.79%,Wespac银行和TSB也宣布跟进,将两年期固定利率调整为2.79%。

/arc-anglerfish-syd-prod-nzme.s3.amazonaws.com/public/IGKOXG7ROZCETGTAR6JG7UAV2E.jpg)

现在,ASB和Kiwibank的最低住房贷款利率竞争一直在继续,ASB和Kiwibank的利率创历史新低。

上周,ASB准备将两年期利率调整至2.69%,而Kiwibank则将一年期利率下调至2.65%。BNZ银行也降低了利率,将贷款期限定为三年,固定为不到3%。

ASB发言人表示:“看到新西兰开始解封,人们能够重返工作岗位,这令人感到鼓舞。但我们意识到,Covid-19疫情的影响仍会持续一段时间,并且我们将继续为客户提供贷款帮助。低贷款利率只是其中的一部分,”

越来越多的人猜测,储备银行可能会将OCR降低至零,甚至为负0.25%,这可能导致个人贷款利率降至2.5%以下,因此这是贷款的绝佳时机!Infometrics的首席预测员Gareth Kiernan说,此次贷款利率下调反映了过去几个月来银行资金成本的下降。

“贷款利率未来是否还会进一步降低的因素取决于储备银行是否进一步增加量化宽松政策并降低长期利率。如果这样的话,OCR将进一步削减,趋势将保持到12月。

然而,有传闻称,许多银行的信贷部门正在收紧对贷款发放的审批,尤其是对新客户的贷款,因此,尽管这在利率下调是好消息,但如果买家未获得银行批准,则是徒劳。在现阶段,有稳定的收入和工作比以往任何时候都重要。

以下是MARS Blog的英文原文:

In a week, the news for borrowers has got a whole lot better with falling mortgage interest rates coming in from every quarter!

Over the course of the past week, ANZ has offered a one-year fixed-term rate of 2.79 per cent and Westpac and TSB announced on Thursday that they would match it. Westpac offered the 2.79 per cent rate out to two years fixed.

Now, the competition between the banks for the lowest home loan rate has continued with ASB and Kiwibank have hit back with record low rates.

Today ASB is moving to offer a two-year rate of 2.69 per cent and Kiwibank a one-year rate of 2.65 per cent. BNZ has also cut its rates, offering loans out to five years fixed at less than 3 per cent.

An ASB spokesperson said “It’s been encouraging to see the country start to re-open and New Zealanders be able to return to work, but we’re conscious that the impacts of Covid-19 will still be felt for a while to come, and we will continue to help our customers through that. Our new special two-year low rate is part of this,”

There is growing speculation that the Reserve Bank may lower the OCR to zero or even negative 0.25% which may cause retail rates to fall to below 2.5% so it is a great time to buy! Gareth Kiernan, chief forecaster at Infometrics, said the cuts were a reflection of the drop in bank funding costs experienced over the last couple of months.

“Any further cuts from here are probably dependent on the Reserve Bank further increasing quantitative easing and driving longer-term rates lower, or clearly signalling that the OCR will be cut further once bank systems are able to cope with it – they have until December to get sorted.

However, there is anecdotal news that the credit dept in many banks are tightening up on granting loans, especially to new customers so whilst this welcome news on the interest rate front, it is of no value if buyers do not get approved. A reliable income and solid job in a non-risk industry is even more important than ever.

获取更多地产投资资讯,请登录:marsrealty.co.nz